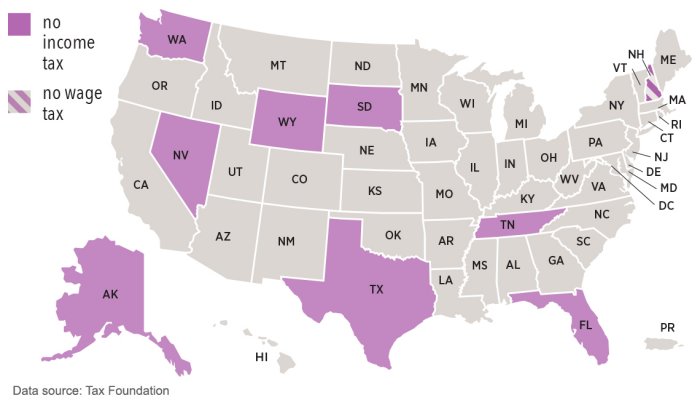

Paychecks and retirement benefits are safe from income taxes if you work or retire in one of these states. See the list of nine states that spare your income from taxation, plus learn how some states fill the revenue void with other taxes.

by John Waggoner, AARP, Updated April 8, 2021

If you want to be very tax-conscious, you should take into account all the types of taxes you may pay. WalletHub rates New York state as having the highest total tax burden, equal to about 12.8 percent of income, followed by Hawaii, at 12.2 percent. Alaska has the lowest tax burden, at about 5.1 percent, with Tennessee in second place, at 5.7 percent. Read article HERE.

Total Page Visits: 1069 - Today Page Visits: 2